PayAttitude app for iPhone and iPad

Developer: unifiedpayments nigeria

First release : 17 Nov 2017

App size: 65.83 Mb

PayAttitude Premium is a single mobile app that welcomes you to a world of convenience of linking multiple accounts in different banks for remote/distant transactions.

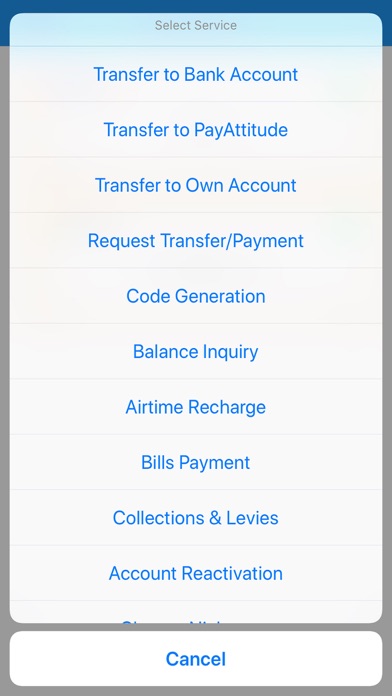

The app grants you 24/7 access to a wide variety of transaction types directly from your mobile phone wherever you are.

Benefits;

• Link accounts in different banks

• Generate one-time transaction code to be used at ATM, POS and WEB by yourself or 3rd Party etc

• Withdraw and Pay through 3rd party securely

• With one-time transaction amount and code, no more internet fraud

• Funds transfer

• Airtime top-up

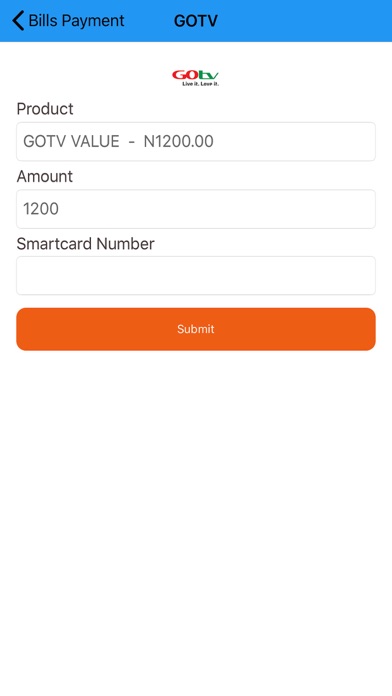

• Bills payment

• Account Statements

• Enables the addition of beneficiaries directly from phone book for airtime top-up

• Save beneficiary details for future transactions

FREQUENTLY ASKED QUESTIONS

1. Q. What do I need, to be enrolled to PayAttitude?

A. Be an account holder in a partner bank OR

B. Walk up to any PayAttitude Agent Outlet to enroll OR

C. Download the premium application after subscribing with bank or Agent and log in with account details.

2. Q. What accounts can I have on my PayAttitude premium App?

A. Bank accounts and/or prepaid accounts

3. Q. What is activation code?

A. A unique code to activate your premium account during premium subscription and also during password reset.

4. Q. What PIN should I use to transact on my PayAttitude premium App?

A. PIN selected at the point of PayAttitude enrollment at the Bank or Agency outlet.

5. Q. What happens if I cannot remember my password?

A. Visit your bank/agency outlet for a password reset.

6. Q. What is my PayAttitude premium account number?

A. Unique masked 16 digits number displayed on the premium App

7. Q. What should I do if my phone is misplaced, stolen or lost?

A. a. Call our Customer Care Centre number on: 01: 2703023 and request for your PayAttitude® to be disabled. OR

b. Visit any branch of your issuer bank and request for your PayAttitude® to be disabled.

8. Q. Will my PayAttitude premium work directly with my Tag?

A. No, the PayAttitude premium app only complements the function of the tag for distant transactions.

9. Q. Will I receive SMS and/or Email alerts for transactions done on my PayAttitude premium App?

A. Yes.

10. Q. What do I need to do to start using PayAttitude® Premium as an existing PayAttitude tag Holder?

A. You will need to install and activate it by doing the following:

• Launch the downloaded application

• Select the “Existing Tag Holder” option on the app.

• Enter the required details on the screen presented by the app.

• Enter the activation code sent to your registered mobile number via sms

• Your PayAttitude® will be linked to your bank account and you can immediately start enjoying the functionalities of PayAttitude®.

11. Q. What do I need to do to start using PayAttitude® Premium if I am new to PayAttitude?

A. You will need to install the app and activate it by doing the following:

• Proceed to your nearest bank branch where you have a bank account or a PayAttitude agency location and request for subscription and activation of your PayAttitude

• Launch the downloaded application

• Enter the Username and default password on the PayAttitude contract

• Enter the activation code sent to your registered mobile number via sms

• Change your default password on the change password screen presented after activation

12. Q. How do I link my accounts in other banks to my PayAttitude® Premium?

A. I) where account is already subscribed to PayAttitude, Click on “Add account to premium “on the app and select account to add. Or visit your bank to add the account.

II) Where the account is not already subscribed to PayAttitude, visit your bank to subscribe the account to PayAttitude and proceed to add the account to premium.

13. Q. Can I withdraw cash with my PayAttitude premium app?

A. Yes. By generating one-time transaction code on the Premium App you can:

• Make cash withdrawals (i) on the ATM (ii) using the POS at authorized merchant locations